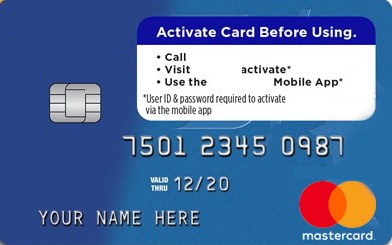

What do you do if you receive a debit/credit card you didn’t apply for?

What to Do When You Get an Unsolicited Debit Card in the Mail

Most consumers are used to receiving unsolicited debit/credit card sales pieces in the mail. Credit card companies often send you what looks like an actual credit card to get you to apply for the real thing.

But an unsolicited debit/credit card? Well, that’s different.

There are only a few good reasons why you should receive an unsolicited debit card in the mail. However, most of the time you’ll only get a debit/credit card if you ask for one or yours expires, but in these cases, it will be from your own bank.

If you get a debit card that you didn’t ask for (especially if you don’t bank with them), take the following precautions:

- Don’t just toss the debit card in the trash or cut it up.

- Check the accompanying paperwork. Does it explain the reason for the new or replacement card?

- Check the sender and the sending address.

- Check the addressee. Was this card sent to you by mistake?

- If you receive a debit/credit card that you didn’t apply for from a bank that you don’t bank with, call the card’s bank immediately. The bank will be able to clarify why you received the card or tell you if it’s a scam. Do NOT use the contact numbers provided in the mail with the card. Do some research and find a phone number for that company from a reliable source and use that.

- Make sure to have them close the account and tell them you did not open it.

- If someone was successful in opening a card under your name, you should immediately place a fraud alert on your credit with

- Equifax – 888-766-0008

- TransUnion – 800-680-7289

- Experian – 888-397-3742

- Debit cards aren’t reported to the 3 major credit bureaus. However, a scammer may now have access to other important personal information that they can use to open up new lines of credit in your name.

- You can also go to https://www.annualcreditreport.com and receive a free credit report.

We encourage you to be very careful with this type of scam. If this happens to you make sure you monitor your credit closely or sign up with a credit monitoring company.